|

|

|

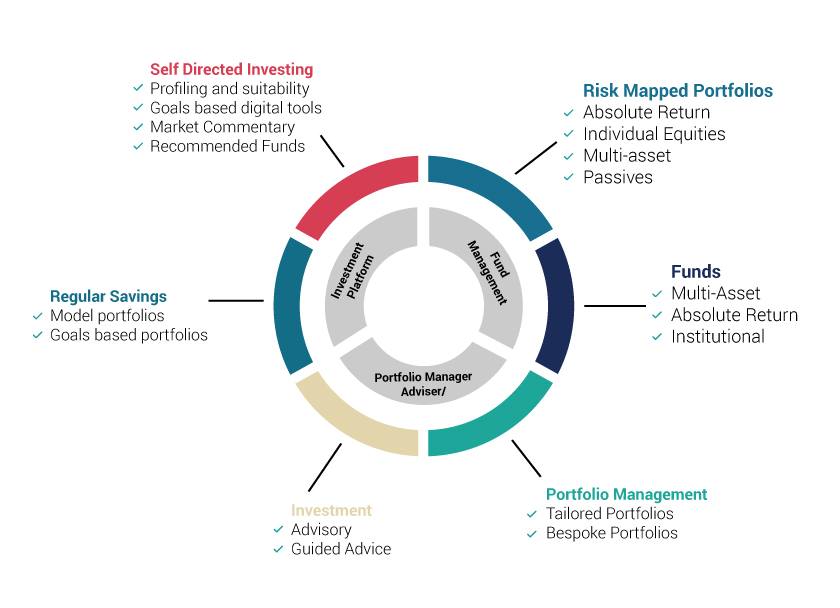

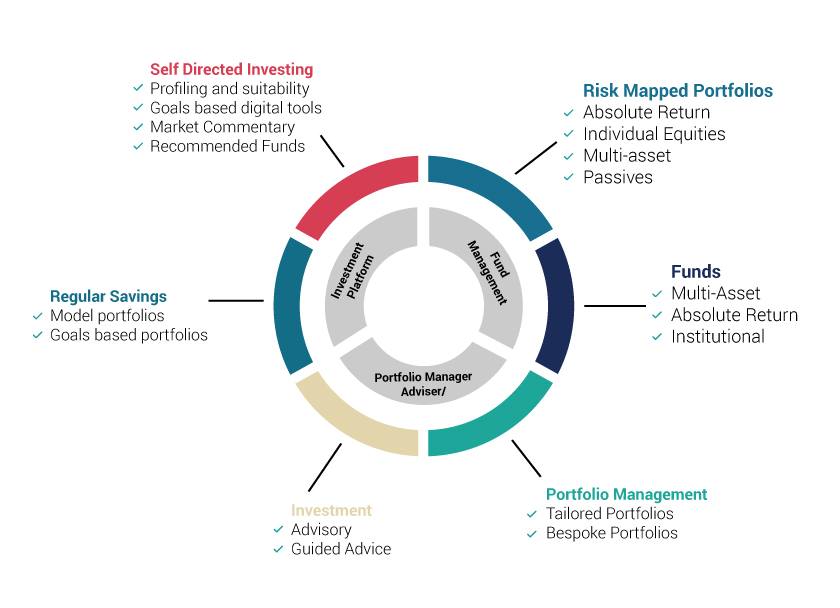

PROFESSIONALLY MANAGED PORTFOLIOS

|

| Over to you You’re in the driving seat. You can deal in investments either by phone or online, and we simply execute your orders. |

Where you take the lead For clients who are comfortable taking the lead, decisions are taken in partnership with an investment manager. |

Where we lighten the load From the very bespoke constructions, or our managed portfolio strategies we have a choice of approaches, including different styles and managers. |

| Built for those who want to retain complete control of their investments. |

Designed for those who would like to manage their own money, but appreciate the support of a professional investment adviser |

A range of risk assessed options including: |

| We provide the technology and resources to support a DIY approach. |

A dedicated adviser will be on hand to discuss market developments and your holdings. |

Discretionary: Bespoke Portfolios, and Tailored Traditional multi-asset portfolios (from 200,000 GBP). |

| The service supports both telephone and online dealing. |

Having made initial recommendations, these are then kept under ongoing review. |

Individual equity/Passive/Absolute Return managed portfolio strategies (from 50,000 GBP). |

| Access the widest range of asset classes, dozens of exchanges and thousands of funds. |

Before investing, your adviser will engage with you to thoroughly understand your circumstances and your aims. |

Benefit from a rigorous suitability process to design an appropriate investment approach. |

| Take advantage from pre-built ‘mini model’ portfolios to benefit from a given theme. |

Benefit from the insights of a longstanding asset management business, with professional fund managers and global reach. |

Continuous monitoring means your investments remain matched to your investing objectives. |

| Invest within a range of tax wrappers including ISAs and SIPPs, or simply in a General Investing Account. |

You remain fully in control of the decision making process at all times. |

A range of styles to suit investing personalities and investing types. |